Annual Plan 2025/26 – sticking to our long-term strategy

Our Annual Plan for the 2025/26 [PDF 3.57 MB] financial year sticks to the strategy set out in our current Long-term Plan (LTP), with minor changes made to adjust for cost increases driven by global and local factors.

About annual plans

We review the details of the long-term plan each financial year and adjust them where needed. The first year of the long-term plan is year one.

Years two and three are reviewed during the annual plan process and are likely to include formal public consultation if we’re looking at making large adjustments.

The annual plan outlines what Council agreed to for the relevant year in the LTP, and any changes.

Sticking to the plan - building a resilient future for Kāpiti

This is year two of the 2024–34 Long-term Plan.

In the coming year, we’ll be progressing the work we agreed with the community and continuing our financial strategy to reduce debt and build resilience. Because the changes we’re making will not impact agreed service levels, formal consultation with the community is not required this time.

In the LTP, we committed to living within a projected rates increase of seven percent after growth for the 2025/26 year. We have made every effort to ensure we achieve this, and to do our bit to help our community in these hard times.

In the last year, cost increases of a further 2.7 percent have arisen, including new water regulation levies from Taumata Arowai and the Commerce Commission, along with higher energy, security, maintenance, and staffing costs.

We have worked hard to remove $3.1m from the budget to offset these pressures to get to an overall rates increase of 6.9 percent.

We did this by:

- Cutting our staff headcount by 15 positions, saving $1.45 million.

- Reducing roading work that is no longer subsidised, saving $259,000.

- Reducing and deferring some grant funding, saving $541,000

- Cutting costs in our office facilities saving $65,000

- Revising work programmes and operational efficiencies saving $382,000.

As well as finding savings we have adjusted our fees and charges in a few areas to recover additional costs of $387,000.

How does this impact your rates?

While the increase in overall rates revenue is 6.9 percent, the impact on rates for your property will depend on your property value, type, and location.

The information below shows the increase for median properties in 2025/26. These figures include GST and water rates based on 255 m3 per year for residential properties and a fixed water rates for commercial properties. Greater Wellington Regional Council rates, which we collect on their behalf, are still being determined and are not included.

Median Property Values

* Median property refers to the middle value when all properties in an area are ranked by their value.

Paekākāriki

Capital value: $860,000

Land value: $540,000

Current rates: $4,565

Increase/[decrease]: $343.36

Increase/[decrease] per week: $6.60

Paraparaumu

Capital value: $720,000

Land value: $410,000

Current rates: $4,475

Increase/[decrease]: $374.67

Increase/[decrease] per week: $7.21

Raumati

Capital value: $760,000

Land value: $450,000

Current rates: $4,656

Increase/[decrease]: $387.88

Increase/[decrease] per week: $7.46

Waikanae

Capital value: $780,000

Land value: $425,000

Current rates: $4,597

Increase/[decrease]: $374.37

Increase/[decrease] per week: $7.20

Ōtaki

Capital value: $560,000

Land value: $300,000

Current rates: $3,921

Increase/[decrease]: $342.94

Increase/[decrease] per week: $6.59

Rural

Capital value: $1,200,000

Land value: $660,000

Current rates: $3,110

Increase/[decrease]: -$11.54

Increase/[decrease] per week: -$0.22

Commercial

Capital value: $770,000

Land value: $485,000

Current rates: $6,054

Increase/[decrease]: $448.75

Increase/[decrease] per week: $8.63

Council has changed how it distributes interest costs to activities for 2025/26, to better align with where debt is incurred. The share of interest assigned to roading is lower, while other areas attract more. As a result, some rural properties which pay for roading but not all other services receive a lower rates increase for 2025/26 compared to other properties.

Calculate your rates

We have a handy rates calculator where you can see what your estimated rates will be for 2025/26.

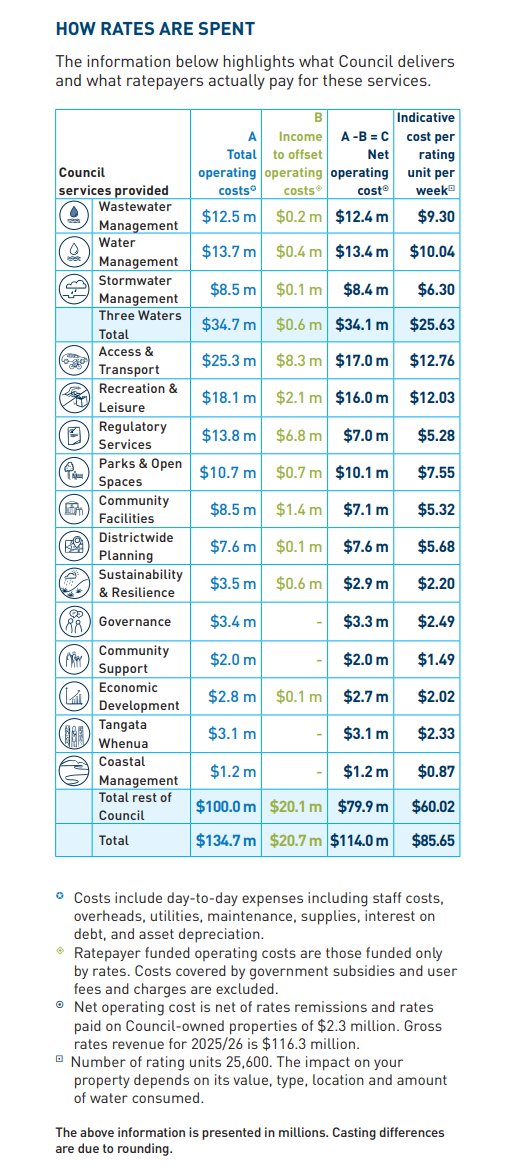

How rates are spent

The information below highlights what Council delivers and what ratepayers actually pay for these services.

Council provided services

|

Three waters

Water Management

Total operating costs: $13.9m

Income to offset operating costs: $0.3m

Net operating cost: $13.6m

Average cost per rating unit per week: $10.22

Wastewater Management

Total operating costs: $12.9m

Income to offset operating costs: $0.2m

Net operating cost: $12.7m

Average cost per rating unit per week: $9.55

Stormwater Management

Total operating costs: $8.5m

Income to offset operating costs: $0.0m

Net operating cost: $8.5m

Average cost per rating unit per week: $6.37

| THREE WATERS TOTAL Total operating costs: $35.3m Income to offset operating costs: $0.5m Net operating cost: $34.8m Average cost per rating unit per week: $26.14 |

Rest of Council services

Access and transport

Total operating costs: $25.7m

Income to offset operating costs: $9.4m

Net operating cost: $16.3m

Average cost per rating unit per week: $12.24

Recreation and leisure

Total operating costs: $18.2m

Income to offset operating costs: $2.1m

Net operating cost: $16.1m

Average cost per rating unit per week: $12.10

Parks and open spaces

Total operating costs: $10.8m

Income to offset operating costs: $0.7m

Net operating cost: $10.1m

Average cost per rating unit per week: $7.62

Districtwide planning

Total operating costs: $7.6m

Income to offset operating costs: $0.1m

Net operating cost: $7.5m

Average cost per rating unit per week: $5.66

Community facilities

Total operating costs: $8.7m

Income to offset operating costs: $1.5m

Net operating cost: $7.2m

Average cost per rating unit per week: $5.44

Regulatory services

Total operating costs: $13.8m

Income to offset operating costs: $6.9m

Net operating cost: $6.9m

Average cost per rating unit per week: $5.15

Governance

Total operating costs: $3.2m

Income to offset operating costs: $0.0m

Net operating cost: $3.2m

Average cost per rating unit per week: $2.39

Tangata Whenua

Total operating costs: $3.1m

Income to offset operating costs: $0.1m

Net operating cost: $3.0m

Average cost per rating unit per week: $2.29

Sustainability and resilience

Total operating costs: $3.5m

Income to offset operating costs: $0.6m

Net operating cost: $2.9m

Average cost per rating unit per week: $2.21

Economic development

Total operating costs: $2.8m

Income to offset operating costs: $0.1m

Net operating cost: $2.7m

Average cost per rating unit per week: $2.02

Community support

Total operating costs: $2.0m

Income to offset operating costs: $0.0m

Net operating cost: $2.0m

Average cost per rating unit per week: $1.48

Coastal management

Total operating costs: $1.2m

Income to offset operating costs: $0.0m

Net operating cost: $1.2m

Average cost per rating unit per week: $0.91

TOTAL REST OF COUNCIL

Total operating costs: $100.4m

Income to offset operating costs: $21.2m

Net operating cost: $79.2m

Average cost per rating unit per week: $59.51

TOTAL

Total operating costs: $124.0m

Income to offset operating costs: $16.9m

Net operating cost: $107.0m

Average cost per rating unit per week: $80.40

Fees and charges

On 29 May 2025, the Council will officially adopt the new schedule of fees and charges for the 2025/26 year. As usual, most fees will increase by the Local Government Cost Index (LGCI) inflation factor, which is forecasted to be 3.2% for 2025/26.

Here are some key changes beyond the 3.2% LGCI increase:

- Building Consent Fees: Fees for code compliance certificates and some LIMs will go up. Online consent application fees will also increase due to changes by our online system vendor.

- Domestic Food Business Levy: A new levy set by MPI will be introduced. The Council will charge a small fee to cover the cost of collecting this revenue for the Government.

- Hall Hire Fees: These will increase by 10% to cover higher costs.

- Learn to Swim Programme: Minor changes include more convenient payment options, flexibility for school participation, and a small regular charge for students to access the pool outside of lessons.

- Access and Transport: Corridor access request fees for project works will increase beyond inflation to cover higher costs.

- Wastewater Fees: Septage disposal and trade waste discharge fees will rise beyond inflation. A new fee for wastewater connection inspections will be introduced.

- Potable Water Fees: Adjustments will be made to fees for water meter special readings, filling point access cards, and water volume charges at Council filling points.

- Waikanae Pop-up Fees: New fees will be established to help cover the costs of the Waikanae Pop-up for start-up businesses in the short term.

Schedule of fees and charges 2025/26 [PDF 722 KB]

Big mahi in 2025/26

We’ve been very busy in recent years upgrading existing or building new infrastructure.

We’ll continue to invest in Kāpiti this year, spending $77m on a range of important projects including:

- Seismic strengthening of the Ōtaki Civic Theatre

- Continuing the Kenakena catchment stormwater project to reduce flooding

- Ongoing upgrades to the Paraparaumu wastewater treatment plant

- Ongoing upgrades to the Waikanae water treatment plant

- The Ōtaki wastewater gravity main

- Building Te Ara Whetū, the new library for Waikanae.

Our financial strategy

You can find the full financial strategy [PDF 6.49 MB] in our Long-term Plan 2024–34.

The overarching theme of our Long-term Plan 2024/34 is “Building a resilient future for Kāpiti”, and we're sticking with this approach in this year’s annual plan. We need to be bold and act to strengthen our resilience for the known challenges we face today and be best positioned for both certain and unknown challenges in the future.

An important part of being resilient is having sound financials, so that if the worst happens – think a Cyclone Gabriel in Kāpiti – we are well-positioned to respond. It also means we have the financial capacity to effectively manage our existing assets and build new assets for growth.

Ensuring this means actively reducing our debt so that over the next decade, our borrowing costs will be less than they would otherwise be if we don't start tackling our rising debt now. In 2033/34, our annual interest costs will be $16 million, which is $7 million less (or $135,000 less per week), for ratepayers.

Lower debt levels increase our resilience by providing the capacity to borrow more money if needed (up to our maximum debt limit), so that we can respond to unplanned natural disasters and maximise affordable growth opportunities. To achieve this, our new strategy will continue to use the three 'levers' – rates, debt, and capex.

We understand the rates lever is of most interest to many ratepayers. In our strategy we have committed to actively reducing debt. To achieve this, we are planning to apply annual rates percentage increases (after growth) of 7 percent year on year from 2025/26 for the duration of the LTP.

Year on year, Council faces real and definite cost increases. These include increased depreciation from asset investment and/or asset revaluation from the prior financial year, personnel cost increases, increased interest costs from increasing debt in the prior year, inflation, increased utility costs, additional activities mandated by central government etc.

Without increasing rates year on year, Council would need to either reduce levels of service or fund everyday costs through borrowing more money.

How will Local Water Done Well impact future plans?

Councils around New Zealand are having to respond to a range of factors like rapidly changing laws, the cancellation of Crown grant programmes, and an increase in unfunded mandates.

One of the most significant changes is the Local Water Done Well reforms.

New water arrangements are not expected to come into effect until 2027/28 to meet the Government’s deadlines. This coincides with the adoption of our next LTP for the period 2027-2037. The LTP will provide for the new water arrangements, whatever they may be, and as is required by the Local Government Act, that LTP will be formally consulted with the community.

Help with paying your rates

We know some of our community have financial constraints. The Government offer a rates rebate scheme for low-income homeowners and retirement village residents who hold a licence to occupy agreement. We also offer a range of rates remission policies. See which of the options might apply to you.